Local EMS costs could see funding return under Senate bill

A bill that could help replace a lost EMS funding source locally moved forward this week.

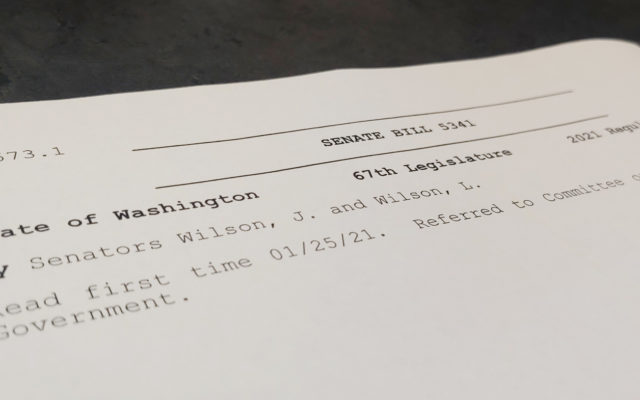

SB 5341 was sponsored by 19th District Senator Jeff Wilson, and if passed would increase permissible uses of existing local sales tax authority to include emergency medical services.

Currently, the existing sales tax authority does not allow for these funds to be used to fund EMS.

The Senate Bill Report states that “Rural districts rely on volunteers to provide emergency services, and an existing funding source is no longer allowed. Due to a narrow interpretation by the state auditor, some areas have lost funding for first responder training. Without training, emergency medical services will no longer exist in some areas. If volunteers were forced to pay for training, there would be fewer volunteers. In certain rural areas, fire and emergency medical services are done jointly. This change would provide more flexibility for local activities, and maintain required training and certification.”

In September of 2020 it was learned that the former source of funding for Grays Harbor first responders was not available. These funds had been filtered through Grays Harbor Transit authority for nearly 40 years, according to sources, but the State Auditor notified officials that this method of funding was no longer available. These funds were used for training and grant costs to local districts, leaving first responders without a funding source.

State law allows counties or cities to submit a proposal to voters to impose up to a three-tenths of one percent sales and use tax on top of the 6.5% state sales tax to be used for specific purposes.

At least ⅓ of funds collected under this tax must be used to fund criminal justice and/or fire protection purposes.

The change to the bill would add emergency medical services to the allowable uses.

On Thursday, the bill was placed into the Third Reading in the Rules Committee and passed out of the Senate Floor with a vote of 49-0.

It now must be passed through the House before moving to the Governor’s desk for signature and passage.

You Might Also Like